Hype Versus Data

From YouTube to TikTok to the backyard barbecue, there are plenty of narratives regarding the pending doom for housing that the underlying data does not support.

The best advice in hearing all the talk swirling around the belief that a real estate crash lurks around the corner is to ignore the noise and stick to the facts.

Many YouTube channels, TikTok, and Instagram accounts are devoted to the housing crash narrative. Either housing is crashing, or it is about to. They are convinced that the market will implode, and values will plunge similar to or worse than the Great Recession. The videos are persuasive in tone but lack the complete picture, ignoring the actual underlying facts. Many of these prognosticators lack the economic credentials and have been calling for a housing collapse for years, steering hundreds of thousands of unsuspecting viewers in the wrong direction, preying on everyone who has been unable to purchase over the years and has been rooting for housing’s demise so that they can finally capture a piece of the American Dream.

Home values rocketed higher from May 2020, right after the initial COVID lockdown, through May 2022. Rates plunged, reaching 17 record lows from March 2020 through January 2021, and remained low through March of last year. As rates climbed, the housing market slowed. After starting 2022 at 3.25%, they eclipsed 5% in May, 6% in September, and 7% in October. In the second half of the year, the housing crash crowd grew louder and louder as affordability eroded and home values declined. Is a housing downturn around the corner? Will home values plunge? The answer is straightforward in looking at the facts, not anytime soon. Ignore all the hype and rely on data.

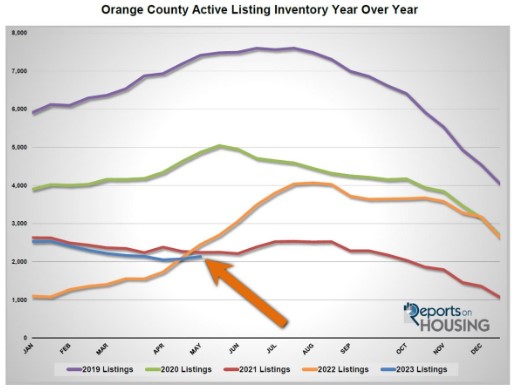

FACT – The active inventory in Orange County is at its lowest level in May since tracking began in 2004. Housing is experiencing a crisis, a catastrophically low level of available homes. During the Great Recession, a glut of homes was on the market. Today, the market suffers from the opposite condition: a minimal supply. For housing to tip in the buyer’s direction, the inventory needs to rise at the very least to pre-pandemic levels. The 5-year average peak from 2015 to 2019 was 7,058 homes. There are only 2,139 homes available today. Last year, the inventory grew substantially from April through August, peaking at 4,069 homes. It stopped climbing due to a lack of sellers coming on the market. The inventory is not poised to rise anywhere near 7,000 homes anytime soon.

Excerpt taken from an article by Steven Thomas.