It’s a Cool, Cool Summer

The summer of 2023 has been characterized by a low inventory, homeowners unwilling to sell, low demand, and a low number of closed sales.

There is a scarcity of homes available, a lack of demand, and very few closed sales even though home values are rising and most homes are selling quickly.

California experienced a very unusual May and June this year. Southern California was subject to some of the coldest daytime temperatures in the last 40 years, far below their norm. There were days without sunshine. The marine layer was so thick that a cool drizzle welcomed morning commuters often. While the rest of the country roasted, Californians grabbed their sweatshirts and wondered if summer would ever arrive.

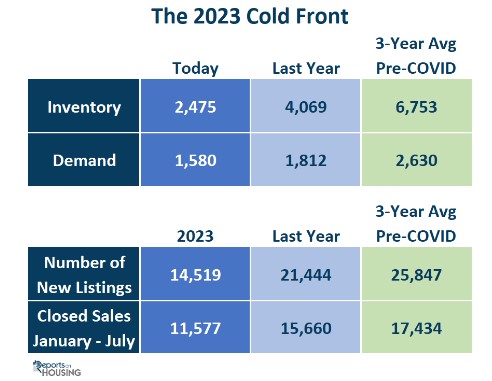

The housing market has experienced a similar cold front where it seems shrouded in a thick fog that will not clear. The higher mortgage rate environment has impacted many real estate statistics and resulted in a very cool summer. The active inventory, demand, and closed sales pale compared to when housing felt “normal” before COVID.

Many would intuitively think that the most significant impact would be in demand, yet the supply of available homes to purchase has suffered the most substantial blow. The inventory started in January 46% below the 3-year average before COVID (2017 to 2019). The difference grew as the year progressed, and the supply failed to rise much at all. Today is 63% lower than that average, sitting at 2,475 homes compared to 6,753 when Orange County felt normal. Today’s level is the lowest inventory for a start to August since tracking began in 2004, even slightly lower than 2021. The low supply in 2021 led to a historic low start to 2022. Similarly, if trends do not change for the remainder of the year, 2024 may break that record low.

The inventory has been at all-time lows not because of unbelievable, hot purchase demand but because of the lack of homeowners willing to relinquish their low, fixed-rate monthly mortgage payments. According to Freddie Mac’s Primary Mortgage Market Survey®, mortgage rates climbed to 6.9% as of August 3rd. Since 87% of Californians with a mortgage enjoy a fixed rate at or below 5%, homeowners are reluctant to sell. Through July, there were only 14,519 sellers to hit the market, compared to 21,444 last year, 47% more, or 25,847 before COVID, 78% additional homes. The lack of available homes has impacted everything from supply to demand to closed sales.

Excerpt taken from an article by Steven Thomas.