Myth Crushing

WHEN IT COMES TO HOUSING, FAR TOO MANY PEOPLE JUMP TO IMMEDIATE CONCLUSIONS WITHOUT CONSIDERING ALL THE FACTS, WHICH IS HOW MYTHS ARE CREATED.

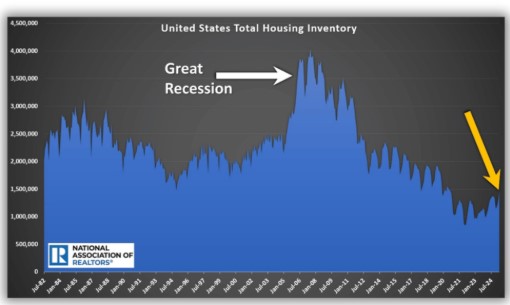

With over 50% of millennials and 70% of Gen Z expecting a housing crash, it is no wonder that numerous YouTube, TikTok, Instagram, X, and Facebook posts are devoted to the demise of the housing market. Negativity sells. It gets the clicks. It supports the narrative that far too many are banking on. First-time homebuyers had to contend with skyrocketing values during the COVID-19 pandemic, and many missed the opportunity to purchase. Today, record-high home prices persist alongside a more elevated mortgage rate environment. When will prices plunge? When will it be the right time to make a purchase? They ultimately turn to social channels that have been habitually incorrect, steering countless consumers in the wrong direction for years. The better strategy is to uncover the facts and ignore the myths. MYTH—Housing is flooded with homes on the market. Across the U.S., the active inventory grew to 1.45 million homes in April, 21% higher than in the same month last year and 39% higher than two years ago. Yes, there are more homes on the market in almost every city and neighborhood; yet, the inventory is rising from record-low levels. It is all about perspective. In April 2019, there were 1.83 million homes, 26% higher than today. In 2016, it was at 2.12 million homes, 46% higher. Yet, those data points were during the housing market’s expansion years from 2012 through 2019. In April 2006, before the Great Recession, there were 3.42 million homes, nearly 2 million more homes on the market. Inventory levels reached 3.81 million in 2008, a substantial 162% higher than today. While demand levels are considerably muted due to the higher mortgage rate environment, they are matched against a limited supply compared to the significantly higher levels of the Great Recession. This fact is one of the main reasons housing prices have been so resilient. MYTH—The drop in home values during the second half of the year will lead to plunging prices. The pressure on home values to fall is building as the inventory has grown extensively, even though demand has remained relatively unchanged. In Orange County, there are 4,595 homes on the market, 75% higher than last year’s 2,620 homes, and more than double May 2023’s 2,190 homes. Today’s demand (a snapshot of the number of new pending sales over the prior month) is at 1,621 pending sales, 2% less than last year’s 1,650 reading, or 3% less than two years ago’s 1,665 pending sales. In examining supply and demand, the supply is increasing, while demand has remained relatively unchanged. This increases the pricing pressure. According to the Freddie Mac House Price Index, the Los Angeles-Orange County metro area experienced a 9% year-over-year gain in March 2024. It dropped to an annual increase of 3% in March 2025. As the inventory continues to grow and demand remains at similar muted annual levels, home values could start to fall slightly. Yet, far too many people get ahead of themselves and expect any drop in home values to be the beginning of a significant downturn that will develop into rapidly falling home prices. The inventory is returning to pre-pandemic levels, which are still significantly lower than those of the Great Recession and previous decades. Today’s United States housing stock is the strongest ever. Ever since the Great Recession, buyers have been purchasing homes with strict qualifications, strong credit, great jobs, and low fixed payments. There is a record amount of tappable equity (the amount of equity a homeowner can use for a loan while still retaining at least 20% equity), a record number of equity-rich properties (those with 50% or more equity), and a record number of homeowners who own their homes free and clear. There will be no housing crash because of the strength of the homeowner and the limited supply, even if the supply returns to pre-pandemic levels.

Excerpt taken from Stephen Thomas