MIDYEAR OUTLOOK

WITH HALF OF 2025 IN THE REARVIEW MIRROR, TRENDS HAVE DEVELOPED THAT ESTABLISH A SLOWING HOUSING MARKET, WHICH RELIES ON ELEVATED MORTGAGE RATES.

There are many crossroads in life where a single decision can take someone down a completely new path. Whether it's choosing a career, getting married, or moving to a new city, each decision shapes a unique and distinct future. Similarly, the second half of 2025 stands at a crossroads, where the pathway of mortgage rates will result in two vastly different outcomes. Will mortgage rates remain elevated, or will they fall below 6.5% with duration? The housing market is at the mercy of rates. Until rates drop, expect more of the same. In recapping the first half of 2025, mortgage rates started the year above 7%, according to Mortgage News Daily, and did not drop into the 6s until mid-February. They bounced between 6.6% and 6.99% ever since, except for four days when they rose above 7% due to the reaction to the tariff announcement and concerns about the deficit following the details of the new tax bill. As a result of the sticky, higher-rate environment, the affordability crisis has persisted, and demand has remained essentially unchanged over the last couple of years. Demand (a snapshot of the previous 30 days of pending sales activity) is currently at 1,565 pending sales, 4% below last year’s 1,624 level, and nearly identical to the 1,560 pending sales reading in 2023.

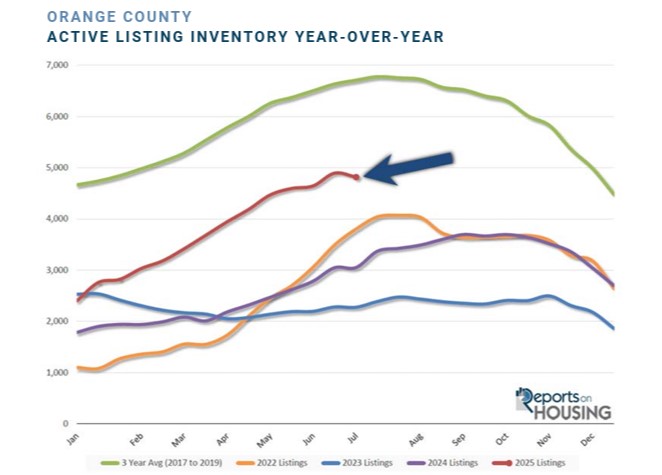

The active inventory is an entirely different story. Homeowners continue to “hunker down” in their homes, unwilling to move due to their current, underlying, locked-in, low fixed-rate mortgage, resulting in 25% fewer “For Sale” signs through June compared to the 3-year prepandemic average (2017-2019). Yet, there were 2,192 additional signs compared to lastyear, and 4,232 more than in 2023. In pairing these extra signs with similar year-over-year demand, they have accumulated and triggered a steep rise in the inventory. The supply of available homes has increased from 2,401 at the start of the year to 4,817 today, a 101% rise, or double. There are 58% more homes available today than at the same time last year, and 112% more than in 2023. As a result of a rapidly accelerating supply of homes and similar, year-over-year muted demand, the Expected Market Time (the number of days it takes to sell all Orange County listings at the current buying pace) has steadily increased from 61 days at the end of February to 92 days today, its slowest start of July pace since 2019. With longer market times, negotiations have shifted in favor of buyers, and they are now calling more of the shots. There is also pricing pressure, and values are slowly declining from month to month. So, where does the housing market go from here? It all depends on rates. There are two scenarios: rates remain elevated and continue to fluctuate between 6.5% and 7% for the remainder of the year, or rates drop and hover between 6% and 6.5% with duration. For mortgage rates to remain where they stand today, the economic data must continue to be similar to that of the first half of 2025. Financial market volatility persists due to ongoing tariff announcements, while strong labor market readings continue, characterized by solid job growth and low unemployment rates. Additionally, any rise in inflation due to the implementation of tariffs will keep a lid on Federal Reserve rate cuts.

Excerpt taken from Stephen Thomas