Like the rest of “daily life,” the housing market has not been spared from the sweeping effects of sheltering in place.

Supply and Demand: A low supply is confronted with low demand.

Life has changed. Public schools, private schools, day care, universities, date night, dine-in restaurants, sporting events, organized sports, concerts, movie theaters, trips to the mall, amusement parks, public pools, beaches, neighborhood parks, travel, and frozen yogurt have all been put on hold. The “stay at home” order has affected every aspect of daily life. The Orange County housing market is no different. A man in Orange County tested positive for COVID-19 on January 25th, becoming the first confirmed case in California.

On March 4th, Gov. Newsom declared a state of emergency for the Golden State. Disneyland closed its gates and most major sports leagues suspended their seasons on March 12th. Schools closed on March 13th. The “stay at home” order was announced by the governor on March 19th. That means that California citizens had been sheltering in place for four weeks as of April 16th.

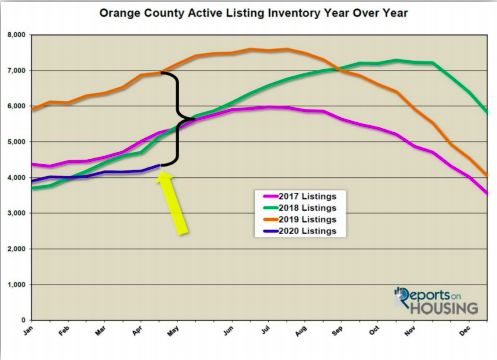

Demand is defined as the past 30-days of pending sales activity. Up to this point, demand readings have included weeks prior to the order when the housing market was still hitting on all cylinders. The market was scorching hot at the very beginning of march despite the state of emergency that was declared. The market began to decelerate in the second week of March. By March 19th, with the kids already at home and preparing for online learning, housing demand slowed to a COVID-19 crawl. It was at inherent demand levels. Now that it has been more than four weeks of virus suppressed demand, the Orange County demand readings are a true depiction of the number of pending sales that will take place under the “stay at home” circumstances. The current reading is an accurate indicator of the current market until the economy begins to reopen down the road. There is a broad housing market interruption due to the Coronavirus that has had a major impact on the velocity of the market, demand, and the supply of homes, the active inventory. Both have been impacted significantly. Yes, demand is at ultra-low, anemic levels, but so is the active listing inventory. Buyers are not writing that many offers, and fewer homeowners are pounding FOR SALE signs in their front yards. As a result of everyday life grinding to a halt, demand dropped by 55% in the past month, from 2,398 pending sales to 1,080. These demand levels were last seen in 2007. Since the “stay at home” order on March 19th, the number of homes placed on the market dropped by 52% compared to the prior 5-year average. That is 1,972 fewer homeowners entering the fray. Consequently, the active inventory has only grown by 185 homes in the past four weeks, a 4% rise, and the inventory now sits at 4,344 homes. While demand may be at Great Recession levels, the inventory is not growing like it

did in 2006 through 2008 when it reached nearly 18,000 homes. In looking at the county’s different price ranges and detached versus attached, the entire market has been impacted. Yet, there are a few ranges that are still functioning. They have evolved from an extremely hot price range to one that still favors sellers but a bit slower. For detached homes, everything below $1 million lines up at least slightly in the seller’s favor. Between $500,000 to $750,000, the “bread and butter” of the local housing market, detached homes are obtaining more offers than any other range and sellers get to call most of the shots. The Expected Market Time (the time between hammering in the FOR-SALE sign to opening escrow) for that range is at 49 days, a Seller’s Market. Four weeks ago, it was at 25 days. For detached above $1,000,000, the market slows considerably, leaning in favor of buyers. Above $2 million has nearly ground to a halt. For attached, only condominiums between $250,000 to $500,000 slightly favors sellers with an Expected Market Time of 85 days. It was at 34 days four weeks ago. The $500,000 to $750,000 price range for condominiums is balanced. All other condominium ranges, including those below $250,000, favor buyers. For attached above $1 million, the market is extremely slow.