Rates Pave Path for Housing

It is all about rates in the housing market, from the number of homeowners willing to sell to the volume of buyers able to afford to purchase. Not only do rates affect buyers, but they also impact the number of sellers.

Just about everyone loves the beach. Basking in the sun, walking along the coast, listening to the soothing sounds of waves crashing on the shore, and taking a refreshing plunge in the cool, salty water, are some of the many reasons so many head to the beach, especially on the weekend. Yet, what happens when it is overcast and cool during the winter? Not as many Southern Californians make the pilgrimage to the beach. There are still plenty of beachgoers when it is cool, from die-hard surfers in their winter wetsuits to locals taking a walk or jogging on the sand. Still, there is a definitive difference between the hot summer days and the crispy winter weather with the wind blowing and temps in the 50s. There are times when beaches seem almost deserted.

Similarly, when mortgage rates are low, the market heats up with a rise in affordability and buyer demand, along with a surge of homeowners desirous of taking advantage of a great time to make a move. Yet, when mortgage rates substantially rise as they did over the past year, demand diminishes due to affordability constraints, and many sellers opt to “hunker down” as they enjoy their underlying, locked-in, low fixed-rate mortgages.

The pandemic was an enormous disruptor, and housing benefited profoundly due to the involvement of the Federal Reserve and the Federal Government. The Fed brought the Federal Funds Rate to zero and bought trillions of dollars of both mortgage-backed securities and treasuries. Mortgage rates dropped to record low levels, instigating tremendous housing demand. The Federal Government passed stimulus packages that sent checks directly to United States citizens. Bank accounts swelled and enabled many buyers to achieve their dream of homeownership. Mortgage rates remained at unbelievably low levels, and housing benefited with a nearly instantaneous, insanely hot market that lasted for two years, from June 2020 to May 2022. That is when the Federal Reserve stepped in and started hiking rates and reducing the number of mortgage-backed securities on their books. Mortgage rates soared, and the Fed slammed on the housing market’s brakes.

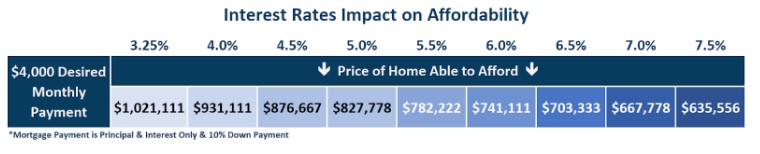

In 2022, mortgage rates started the year at about 3.25%, according to Mortgage News Daily, and surpassed 7% in both October and November. It was a constant erosion of purchasing power for buyers looking to purchase. Last year’s giant jump in rates had a significant impact on affordability. For example, buyers desirous of a $4,000 per month principle and interest payment with 10% down started the year looking at a $1,021,111 home. By October, with rates above 7%, the same buyer was looking at a $665,000 home

Excerpt taken from an article by Steven Thomas.