Affordability Predicament

Even though the housing market is hot once again, many buyers have been pushed to the sidelines due to the high mortgage rate environment.

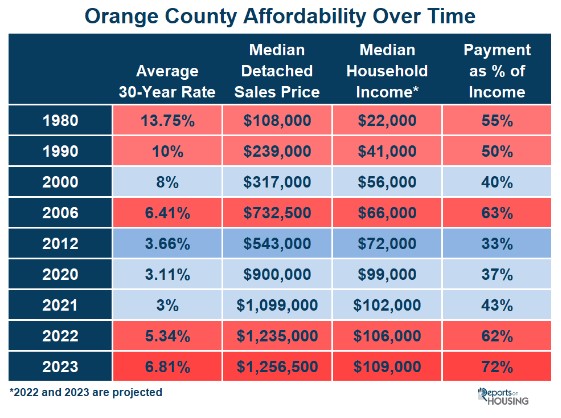

Today’s monthly payment is 72% of the median household’s monthly income at the current rate and median detached sales price.

This year’s housing market is booming despite the higher mortgage rate environment. Open houses are lined with buyers. Bidding wars have returned, along with homes selling above their asking prices. Housing is crazy once again. To many, it seems as if more buyers are looking to purchase today than before the pandemic, or very similar to the COVID years of the second half of 2020 through the first several months of 2022. Yet, the actual number of buyers in the marketplace is far fewer than many realize. How can that be?

It is as if Disneyland decided to limit attendance to 50% of its average summer ticket sales. Park attendees would expect to walk on just about every ride. But once they enter the “Happiest Place on Earth,” they quickly find that only half the attractions are open, and the lines are just as long as a typical summer day. That is precisely what is going on in the housing market today. With rates at nearly 7% and affordability at tragically low levels, buyers would expect to take their time as homes for sale sit and sellers anxiously wait for any purchase offer to come in. However, there is a catastrophically low number of homes available, resulting in buyers competing to purchase.

Today’s Orange County housing market is characterized by a lack of affordability, low demand, a limited number of homeowners willing to sell their homes, and an extremely anemic inventory. To understand why buyer demand is weak, it is essential to consider where interest rates, incomes, and home prices have been over time and their impact on affordability. Interest rates have been higher than they currently stand today, but that does not mean it was more unaffordable. In 1980, the average mortgage rate was 13.75%, the median income was $22,000, and the median detached sales price was $108,000. That meant the monthly housing payment was 55% of the median household income. Rates continued to drop, and incomes climbed decade after decade. In 2000, mortgage rates were at 8%, the median income more than doubled in 20 years, rising to $56,000, and the median detached sale price climbed to $317,000. Yet, the monthly payment was only 40% of the median income. It ballooned to 63% in 2006, just before the start of the Great Recession, and dropped to 33% in 2012 as housing began to climb again. In 2020 and 2021, even as the median price of a home had soared to record levels, the monthly payment was at 37% and 43% due to historically low mortgage rates and a median household income that nearly doubled again in 20 years. Affordability was not an issue as mortgage rates had dropped to record lows.

That changed in 2022 when mortgage rates soared and averaged 5.34% for the year, and eclipsed 7% in October and November, climbing to 20-year highs. As a result, the monthly payment for the $1,235,000 home was 62% of the median household income. According to Freddie Mac’s Primary Mortgage Market Survey®, rates rose to 6.81% last week, and the California Association of REALTORS® reported that May’s median detached home increased to $1,256,500 for Orange County in May. An astounding 72% of the median household income would be devoted to paying the monthly payment. Only buyers with incomes that far exceed the median or buyers with cash in the bank are able to purchase today. Home affordability is at record lows.

Excerpt taken from an article by Steven Thomas.