No Bargains

Many buyers are looking for a deal or waiting for the housing market to crash before they purchase, but that is not going to happen anytime on the horizon.

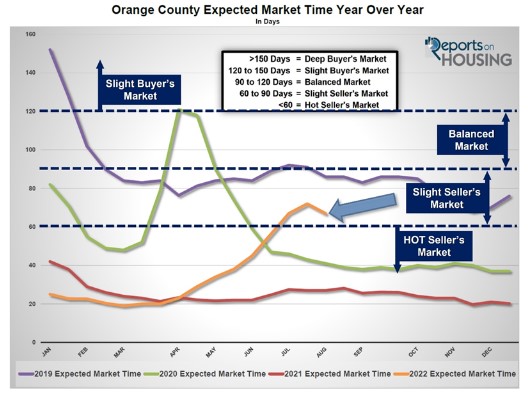

The insane, instantaneous housing market may be gone, yet with an Expected Market Time of 67 days, Orange County is still a Slight Seller’s Market.

The looming recession has buyers on the edge of their seats fully aware that the housing market has slowed considerably. From the flood of online news articles describing the real estate slowdown to the countless YouTube and TikTok videos detailing in only a few minutes how housing is about to crash, many buyers are convinced that the Orange County housing market is on the brink of collapse. Homes are taking a lot longer to sell. The number of price reductions has surged higher in the past couple of months. As a result, many buyers sit on the sidelines waiting for prices to plunge. They are waiting for a deal, a total bargain.

Just because so many people are jumping to the conclusion that home values must plummet does not make it so. Merely mention a recession and everyone’s collective minds recall the devastating blow to housing during the Great Recession. Instead, homeowners across the country purchased their homes with huge down payments, extremely strong credit scores, money in the bank, and qualified for their mortgages. Buyers over the past many years have not been purchasing homes utilizing subprime loans, pick-a-payment plans, teaser rate adjustable mortgages, or zero down programs. This is not 2005 to 2008 all over again.

Instead, with an Expected Market Time (the time between hammering in the FOR-SALE sign to opening escrow) of 67 days, it is a Slight Seller’s Market (between 60 and 90 days). It is not a Balanced Market (between 90 and 120 days). It is not a Buyer’s Market (over 120 days). The market still lines up in favor of sellers. In fact, in the past two weeks, the Expected Market Time dropped from 72 to 67 days. Surprisingly, the Orange County housing market got a little hotter. It appears as if this year’s rise in market time has stopped and will remain a Slight Seller’s Market for the remainder of the year. This is due to the active inventory nearing its 2022 peak, rising by only 28 homes in the past couple of weeks, and demand jumping by 7% with rates falling to levels last seen in April.

Excerpt taken from an article by Steven Thomas.