Low Supply vs. Low Demand

Match severely weakened demand due to the sharp rise in mortgage rates with a relentlessly low supply of homes, and the result is a substantial slowdown in housing that still favors sellers.

Even with ultra-low demand, the Orange County housing market lines up in favor of sellers due to the persistent lack of supply.

In the past week there has been a lot of noise about a “housing recession.” It was revealed that closed sales plummeted in July. In Southern California, sales were off by 37% compared to 2021. As a result, proclamations from experts across the nation exclaimed that the housing market is officially in a recession. Unfortunately, way too many people will jump to the conclusion that values are going to plummet like they did during the Great Recession. The recession that experts are alluding to is a major drop in sales, fewer purchase and refinance loans, and an overall limited number of transactions for all those involved in the real estate industry. Yet, a recession does not mean that housing is in crisis and that values will plummet. Only two of the last six recessions prompted a drop in home values, the Savings and Loan Scandal of 1991 and the Great Recession, both instigated by the missteps of the housing industry. The other four recessions resulted in an appreciating housing stock.

Every recession is different. During the Great Recession unemployment skyrocketed and housing was a huge “house of cards” built on years of subprime loans, pick-a-payment plans, teaser rate adjustable mortgages, and fraudulent lending practices. It was not a shock that housing values sank. This “recession” will be entirely different. Thus far in 2022, the Orange County housing market has slowed from an Expected Market Time (the time between hammering in the FOR-SALE sign to opening escrow) of 19 days in early March to 65 days today, yet the slowing has stopped. In fact, the market time has dropped by 7 days since climbing to 72 days a month ago. To understand why housing has shifted but is not on the verge of collapse, look no further than to good old-fashioned supply and demand.

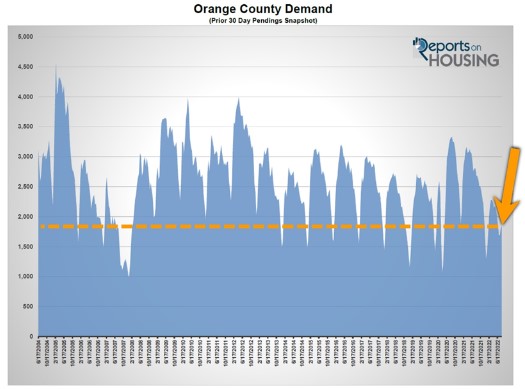

On the demand side of the equation (a snapshot of the number of new escrows over the prior month), buyer activity has been muted all year. A premature peak was reached at the end of March with 2,286 pending sales, down 28% from last year’s peak of 3,162 pendings. Compared to the 3-year average peak prior to COVID (2017 to 2019) of 2,816, this year was 19% less. Today, demand sits at 1,849, slightly higher than where it stood a month ago at 1,693. Even with the recent rise, today’s reading is the lowest level for this time of year since 2007, the start of the Great Recession. The current demand level is typically reserved for the slowest time of the year for real estate, January, with a 3-year average pending sales(2017 to 2019) of 1,551 pending sales, and December, 3-year average of 1,637. The August 3-year average is 2,506 pending sales, 36% higher than today.

Excerpt taken from an article by Steven Thomas.