Challenges of Supply Situation

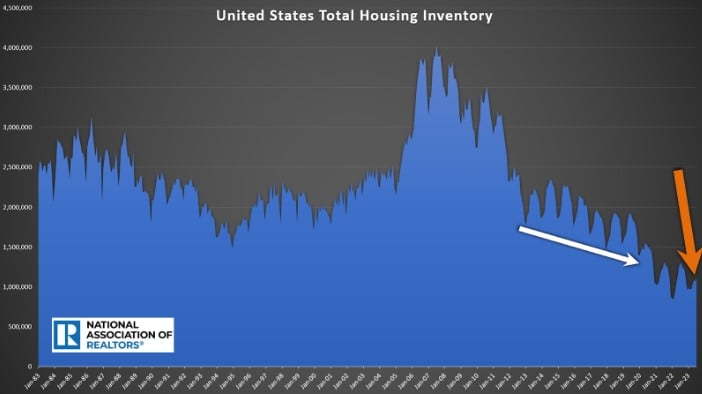

The inventory was falling from year to year before the pandemic, but levels have grown more acute post-COVID with a lack of forced selling and far fewer homeowners placing their homes on the market.

Before the pandemic, there were nearly three times as many homes on the market as today, and that will not change anytime soon, according to current trends.

It is getting harder and harder to find toy stores, bicycle shops, and sporting goods stores as more consumers turn to online shopping. Toys R Us closed its doors in 2017, Performance Bicycles sold its last bike in 2019, and Sports Authority filed for bankruptcy in 2016. These were all major national chains. Their closings, along with many small mom-and-pop shops, have made holiday shopping a lot more challenging. For many goods, what used to be a short drive down the street has turned into an internet search for a retailer that has what you are looking for “in stock,” and often a long drive. As a result, many have turned to internet shopping to avoid the hassle.

Similarly, finding homes available for sale has been getting harder and harder. While there used to be an abundant supply of homes to purchase, slowly but surely, the inventory has diminished substantially. There is no longer a plethora of homes to choose from. In many price ranges and neighborhoods, the shelves are bare, and the stock is limited. Buyers cannot turn to the Internet for an increased supply of houses. Instead, it has become a significant waiting game.

Today’s supply dilemma can be traced back to the Dodd-Frank Act, a 2010 law in response to the Great Financial Crisis. It prevented excessive risk-taking on Wall Street and provided common-sense protections for consumers in obtaining a loan. Predatory lending vanished. Nearly 35% of all mortgages were adjustable loans before the Great Recession. Today, it is less than 5%. Subprime lending, pick-a-payment plans, teaser adjustable-rate mortgages, and many other predatory lending products no longer exist. They have been replaced with fixed-rate mortgages and tight lending standards where borrowers must prove they can make their monthly mortgage payments.

Tight lending standards and fixed rates have resulted in a very healthy homeowner stock where fewer homeowners get in a pickle that forces them to sell. The total U.S. housing inventory peaked at just over 4 million homes during the Great Recession. There was a glut of homes available. From 2012 through 2019, inventory levels shrunk from year to year.

Excerpt taken from an article by Steven Thomas.