The housing market continues to see strength in 2019

Bankrate’s Natalie Campisi reports that as the third quarter of 2019 closed, homebuyers were in control, with lower rates and slowing home price appreciation. Housing inventory, however, remains squeezed.

Campisi quotes Fannie Mae’s chief economist, Doug Duncan: “Our view is that the housing market peaked in 2017, we saw about a 3 percent drop in sales in 2018. The pace of home price increases started to slow in 2018. Starting at the beginning of 2019, rates started to come down, and then we saw this big drop in rates. We didn’t expect such a significant drop-off — it was 30 points more than we forecasted.”

According to Bankrate’s weekly indexes, during the third quarter of 2019, mortgage rates fluctuated nearly 50 basis points, with the China-US trade talks prodding investors toward shelter in US Treasuries, all of which helped flatten interest rates. “Most experts predict that rates will remain flat, but there’s no promise as things can change overnight,” says Campisi.

Inventory, however, remains low. “On the for-sale side, the homes that are being started are priced above what many homebuyers are prepared to pay, so there’s an affordability problem,” says Michael Neal, a senior research associate in the Housing Finance Policy Center at the Urban Institute.

It’s no secret that construction costs and labor shortages continue to plague the entry-level construction market. “Costly resources, including everything from building materials and permit prices to labor, drive up construction costs, which filters through to the price of the home. This is one reason folks are staying in their houses longer,” says Campisi.

While millions of homeowners are refi eligible, many might be waiting for better deals before locking in a rate. However, experts warn that homeowners could end up losing out if there’s an uptick in rates.

Sources: BankRate, FannieMae, WellsFargo, TBWS

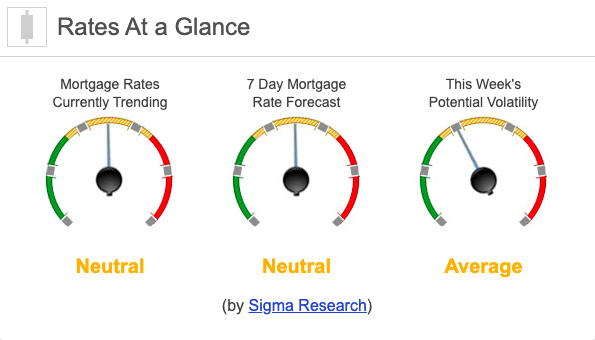

Rates Currently Trending: Neutral

Rates are trending sideways to slightly higher so far today. Last week the MBS market improved by +10bps. This caused rates to move sideways for the week on relatively low volatility.