Low single-family housing inventory persist as the decade begins

While getting perspective on what the real estate market was like a decade ago can help make you appreciate the current market, it won’t make some realities disappear. Back in 2010, many homeowners were desperately hoping to hang on to their homes. Others were desperate, doing everything they could to attract buyers. Those buyers were happy with being courted by home sellers but were struggling to get financing from lenders who had seen their industry take a cautious turn after having so much flexibility for so long.

According to realtor.com’s managing editor Cicely Wedgeworth (using data collected by its chief economist Danielle Hale), the past ten years have been the most consequential stretch in American real estate history —one that has fundamentally altered the landscape. “Cosmopolitan coastal cities are out; affordable midsize cities are in,” she says. “Baby boomers and Gen Xers are no longer the dominant forces in buying, ceding that turf to millennials. Yet after all this time, it seems that home buyers still can’t get much of a break.”

In her housing trends study, Hale admits that while there will be opportunity for millennial buyers in the coming decade, in many ways the challenges buyers have faced for years are going to persist—challenges like difficulty finding the home that’s right for them, and competing with other buyers, especially at affordable price points. Low inventory has been making things tough for buyers since 2015, and next year inventory could reach historic lows, with single-family home construction increasing but falling well short of keeping up with demand. The bright side? Mortgage rates are expected to remain reasonable.

Millennials continue to be the driving force, while achievable prices are continuing to present challenges for them. According to Hale, they often place themselves in positions to overpay, especially if they are trying to find homes in larger cities. Price points are driving them to smaller cites, where sales are expected to be healthier.

“Texas, Arizona, and Nevada are expected to welcome an influx of home shoppers priced out of California,” says Wedgeworth. “Meanwhile, would-be buyers from pricey Northeastern markets will likely head to the Midwest or Southeast. There, they can find affordable housing as well as solid, diversified economies.”

Millennials are no longer the new kids on the block.” The largest cohort of millennials will turn 30 in 2020—historically, that’s when people tend to think of buying their first home,” says Hale. This means the oldest millennials will be turning 39 and the demographic will account for more than 50% of mortgages taken out in the country — more than all other generations combined.

While millennials (those born between 1981-’97) are big on buying experiences instead of “stuff,” they are not that radically different from past generations, partnering off and starting families, which triggers home-buying decisions. Having kids is a huge driver for home sales. “But while they may be motivated, they’ll face a lot of competition for the scarce homes on the market—from roughly 71 million of their peers nationwide,” says Hale.

What about everyone else? Wedgeworth notes that Gen Xers and boomers are pretty comfortable where they are. Boomers, not quick to accept older age, are living longer, healthier lives, and staying in their houses longer, while Gen Xers aren’t quite ready to retire, making them stay right where they are. What this translates into is fewer homes on the market.

As for new construction, Wedgeworth notes, “After the housing crash in 2008, which wiped out quite a few builders, those who remained have largely focused on higher-end developments with bigger profit margins. Although they’re finally showing signs of a shift toward building more entry-level homes, faced with overwhelming demand, it will take a few years for a significant number to come to market.”

Sources: Realtor. TBWS

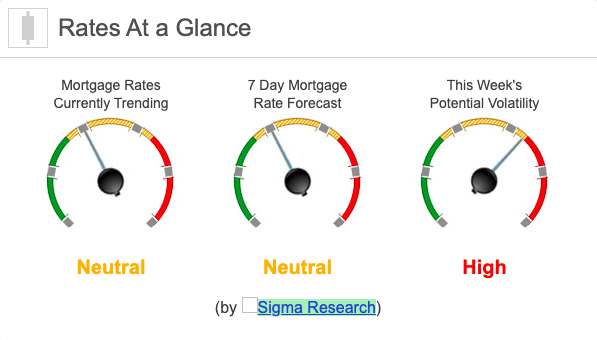

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this today. Last week the MBS market improved by +33bps. This was enough to move rates or fees lower last week. We saw high rate volatility at the end of the week.