Accessory dwelling units are being used for fun, family and profit

Casitas. Granny flats. Tiny homes. Back yard in-laws units. She-sheds. Man caves. Call them what you will, but across the country they are now being used not only for fun, but for profit as well.

According to a recent article by CNBC, the latest housing trend in backyards around America is the emergence of the accessory dwelling unit (ADU), cropping up in back and side yards across America, acting as either rental units or additional space for aging parents and still-nested adult children.

Writer Diana Olick says, “Growth in the sector has been fueled by changes to local and state zoning rules. Some municipalities are struggling with a lack of affordable housing and see these additional units as one remedy.” She goes on to describe how in 2010 Portland, Oregon waived impact fees for ADUs, making them significantly less expensive. As a result, the number of ADU permits jumped from 86 in 2010 to 660 in 2018. Same thing happened in California when a 2017 state law forced cities to relax ADU regulations, where permits jumped even more dramatically.

This means huge growth for ADU builders, who are eager to expand the market and drive the number of ADU installations up dramatically. Financing for ADUs is still looking for a home, however. “ADU is still really for the most part an affluent homeowner product, meaning you have to have cash on hand to take this on,” says one ADU builder. “Financing is a concern for the larger homeowner universe.”

As for he purposes these tiny dwellings are serving, ADU builders are reporting that interest is evenly split between those looking to address housing for family members and those seeking rental income. Pricing depends on the size of the unit, of course, but the most popular model, with the most common size is running just under 300 sq. ft. and cost around $105,000 to install.

Whether it’s housing family or renting out their units on AirBnb, many ADU owners look for their units to provide an even bigger financial return in retirement. One couple in the article lived in their ADU for nearly a year while renovating their main dwelling. Their plan? Someday they want to live in (visit?) their ADU and rake in the cash by renting out their house, traveling and doing whatever they please.

Local zoning regulations remain as one of the greatest roadblocks for ADU builders. While it is definitely becoming easier to build ADUs in some local areas, Olick reports that there are still battles big and small, from zoning to neighborhood opposition. “Some don’t want to see their neighborhoods crowded with renters, pushing density and services beyond capacity.”

Before considering adding an ADU to your property, experts recommend you not only check with your neighborhood’s rules and regulations. Talk to your neighbors as well, because especially in many upscale neighborhoods NIMBY (not in my backyard) is alive and well.

Source: CNBC, TBWS

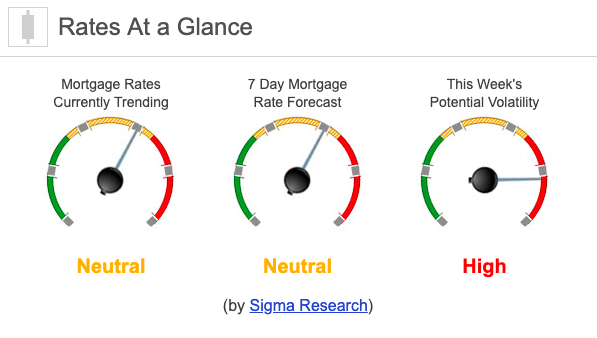

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -2 bps. This caused rates to remain unchanged for the week. We saw low rate volatility through the week.