First-time homebuyers often feel unprepared for ownership

For some it seems like a no-brainer. Renting a home feels like throwing money away, offering no sense of ownership whatsoever. Buying a home is investing in the future. Even if it takes up to 30 years to pay off the loan, you have been LIVING in your investment.

According to a new study by Framework, however, there is more than meets the eye with first time home buyers, who see it as laced with blind spots and pre-loaded with anxiety — mostly because they went into it fairly blind, without enough education and information. The surveys were completed by two groups: recent first-time homebuyers and prospective first-time homebuyers.

The report says only 41% feel very well prepared for the home buying process, 57% worry they can’t afford homeownership, 47% think the home buying process is “rigged” against the buyer, 44% fear making costly mistakes, and 55% said they could use an independent advocate to coach them through the process of home buying and homeownership. On top of that, more than half of first time home buyers in both groups said buying a home was more difficult than it should be.

So what does this tell the average real estate professional or mortgage loan officer? That they may have fallen short of making their buyers literate enough to have confidence in the process? While, once they had been through the process of buying a home, 64% of responders said they emerged from it knowing a lot more about the financial aspects of it, most wished they had taken some kind of class to prepare them for it.

When you think about it, those in the industry often don’t do a great job in explaining aspects of homeownership not in their purview — things like paying taxes, how and when a payment can adjust, or promoting the idea of having a home ownership “slush fund” in the case of an emergency, such as flooding, a failing roof, or plumbing leaking underground. Of course, these aren’t included in the warm, fuzzy feelings industry professionals care to project as they lead buyers through the process, but that doesn’t mean first-time homebuyers shouldn’t be encouraged to find classes or sources that address their concerns.

CurrentMortgageRatesToday.org says that while the largest cost of owning a home will be your monthly mortgage payment, there are several other costs that you should be aware of when trying to find out how much homeownership will cost you — things like an HOA fee (and what it covers), property taxes, homeowner’s insurance, and utilities. And then there is maintenance and repairs.

There are always risks inherent in any large purchase. But it’s up to the potential homeowner to decide if it’s the best financial step for them. Lenders and Realtors often offer courses for first-time homebuyers, but they can also be found online as well.

Source: PRNewswire, currentmortgageratestoday.org, TBWS

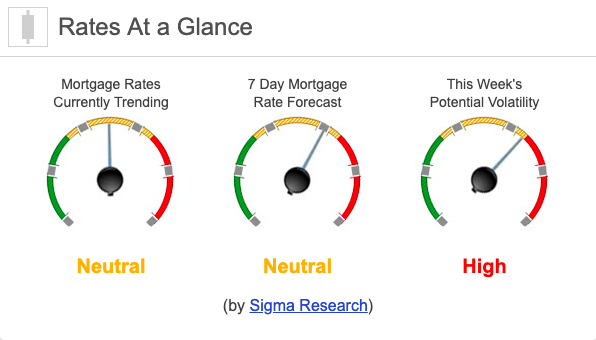

Rates Currently Trending: Neutral

Mortgage rates are trending sideways so far today. Last week the MBS market worsened by -1bps. This caused rates to trend sideways for the week. Rate markets started to settle down through the week. We could see a good deal of rate volatility toward the end of the week.