Insanely Hot Seller’s Market

With a ridiculously record low supply of homes available to purchase matched with strong demand, the housing market is white hot.

The COVID-19 pandemic has severely disrupted the supply of goods and commodities. Initially, back in March 2020, there was a relentless run on toilet paper when people stood in long lines for hours as new shipments arrived. As the pandemic evolved, so did the impact on the supply of computer chips, which ultimately hit the automobile industry the hardest. Flash forward to today and new car lots are empty, there is a COVID premium on the sticker price, and many must wait weeks or months for delivery. It is just as challenging to obtain a used car and prices have gone through the roof. It boils down to supply and demand. Even when demand levels do not change much, yet inventories drop substantially, prices soar.

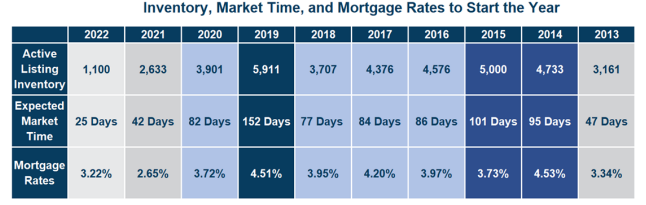

That is precisely what is occurring in the Orange County housing market today. The supply of homes available to purchase today is at a staggering, mind blowing, record low level, and it is matched with strong demand that is not much different than prior to the pandemic. As a result, the market has been white hot, insane, from day one of 2022. It is an unprecedented start to the year that is without comparison. On January 3, 2013, according to the Primary Mortgage Market Survey conducted by Freddie Mac for the past 51-years, mortgage rates were at 3.34%, slightly higher than the record low, at the time, of 3.31% achieved on November 21, 2012. On January 7, 2021, mortgage rates hit a 17th record low since the start of the pandemic, dropping to 2.65%. That rate remains the record today, a year later. On January 6, 2022, mortgage rates had risen to 3.22%, the highest level since May 2020. Even with higher, rising mortgage rates, the housing market already has exceptionally strong momentum.

As the inventory dropped, housing has grown hotter and hotter. Today, there are only 1,100 homes available to purchase, an unmatched, ultra-low supply of homes that shattered the prior record low achieved in January 2021, at 2,633 homes. Last year’s start crushed the 2013 record start of 3,161 homes. The active inventory had been dropping prior to COVID, but the pandemic further disrupted housing and intensified the inventory crisis. The crisis had evolved into a catastrophe by the end of 2021 as the fewest number of homes come on the market in December and the second fewest occurs in November. That set up the unprecedented start to this year.

Excerpt taken from an article by Steven Thomas.