Rising Rates Vs. No Inventory

There are two opposing economic forces impacting the housing market right now, rising mortgage rates and a record low supply of homes available to purchase.

The supply chain problems have been well documented across the United States and around the globe. One of the hardest hit industries is new cars. The supply of available new cars has dwindled down to record lows. As a result, dealers are adding a “market adjustment fee,” a line-item cost above the MSRP. The fee ads anywhere from a few thousand dollars to as much as $20,000 more for a popular model. It has everything to do with supply and demand. Consumers looking for a new car are confronted with very few options and rising car prices. To get their hands on one, many are willing to pay the surcharge.

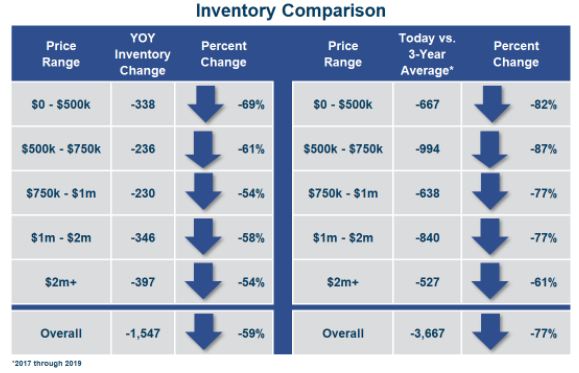

Housing feels like it too is suffering from the supply chain problem with seemingly nothing available to purchase. Last year the inventory in Orange County started the year at an all-time low with 2,633 available homes. It hit 2,214 on June 10th, rose and peaked in June, and then continued to plunge until only 954 homes were on the market on January 1st of this year, just a few weeks ago. Today, there are only 1,080 homes, adding only 126 during the first few weeks of the year. The difference between this year and last year’s record low is striking. There are 1,547 fewer homes today, 59% less. Every price range has been similarly impacted.

Excerpt taken from an article by Steven Thomas.