Summer Slowdown

The shift in housing due to higher rates has already made a significant impact on the housing market, and it will slow further over the summer.

Road trip!! Living in California, it is of no surprise that so many families climb into their SUVs, packed to the gills with luggage, and explore the Golden State. After traveling 70-plus miles per hour for hours without a break, there comes a point where it is time to get off at the next exit, fuel up, and stretch the legs. Upon exiting the freeway and driving to the gas station at a much-reduced speed, it seems as if the car is barely moving. Of course, it is still progressing down the road, but everyone has become accustomed to the much faster speed.

That is precisely how it has felt to participate in the housing market in 2022. The market had been zooming along for the past couple of years at an insanely, swift, unprecedented pace. It was as if the gas pedal was permanently fastened to the floorboard. There were very few homes available to purchase, demand was through the roof compliments of historically low mortgage rates, homes would last only days on the market, swarms of buyers toured every home, each offer to purchase competed against a slew of additional offers, sales prices soared above their asking prices, and home values rocketed higher. But, with higher mortgage rates, the market has slowed considerably, and this summer it will feel as if housing is barely moving. Yet, it will still be a Seller’s Market, just not what everyone has become accustomed to.

With a higher-than-expected Consumer Price Index report that just came out last week, according to Mortgage News Daily mortgage rates leapt from 5.5% on Thursday, June 9th, to 6.13% on Monday, June 13th, an enormous, extraordinary jump. They were at 3.25% at the start of the year and have escalated by nearly 3 points since. The higher rates have already had an enormous impact on housing so far this year, and the recent rise will only further slow the market. Rates are rising in anticipation of everything that the Federal Reserve will need to do in order to tamp down stubborn inflation.

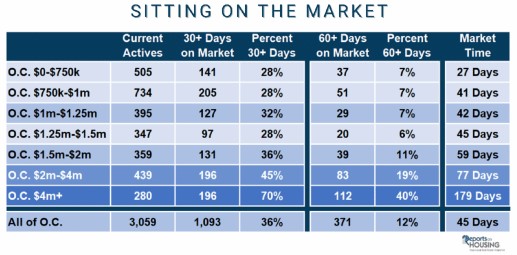

Higher rates dampen demand, homes take longer to sell, and market times grow longer. Today’s demand is muted compared to last year, down 34%, and the 3-year average prior to COVID (2017 to 2019), down 27%. Fewer buyers qualify to purchase at today’s higher rates, so there are not as many buyers bumping into each other. As a result, the inventory has more than tripled so far in 2022, growing from 965 homes to start the year to 3,059 today. The Expected Market Time (the amount of time between hammering in the FOR-SALE sign to opening escrow) has blossomed from 20-days at the end of March to 45-days today, still a Hot Seller’s Market (less than 60-days), just not an insane, instantaneous pace. Many homeowners are not finding success. Incredibly, 36% of all current active listings have been exposed to the market for at least one month.

Excerpt taken from an article by Steven Thomas.