GO FOR GOLD – DON’T WAIT

A WINDOW OF OPPORTUNITY

Olympic gold medal winners perfect their game plans and execute precise timing and strategy to succeed. On the track, many runners wait too long for their final push and cross the finish line out of medal contention. The commentators exclaim that they “should have gone sooner.” The athletes are left second-guessing themselves, wishing they had not waited. Many buyers have been sitting on the sidelines, waiting for rates to come down. Now that rates have plummeted from 7.5% in April to 6.34% today, according to Mortgage News Daily, many buyers wonder if they should pull the trigger and purchase now or wait for rates to fall further. Sitting on the fence and waiting will prove to be the incorrect strategy, leaving many to wish that they had bought sooner.

Long-term, 30-year mortgage rates move ahead of the Federal Reserve Rate cuts. The Federal Reserve (Fed) has not cut rates once since the historical increases from 2022 through 2023, yet mortgage rates have moved all over the place, even eclipsing 8% last October. The movement is based on where investors believe the direction that the Fed’s short-term Federal Funds rate policy will move. With inflation continuing to ease, the job market cooling, and unemployment rising, it is becoming increasingly clear that the FED is too restrictive, and they will need to cut rates when they meet in mid-September. As a result, in less than two weeks, mortgage rates have plunged from 6.91% to 6.34% today. September’s rate cut, currently projected to be a 0.5% snip by Wall Street, is already baked into today’s mortgage rates. When they do trim the Federal Funds rate in September, do NOT expect mortgage rates to drop another 0.5%.

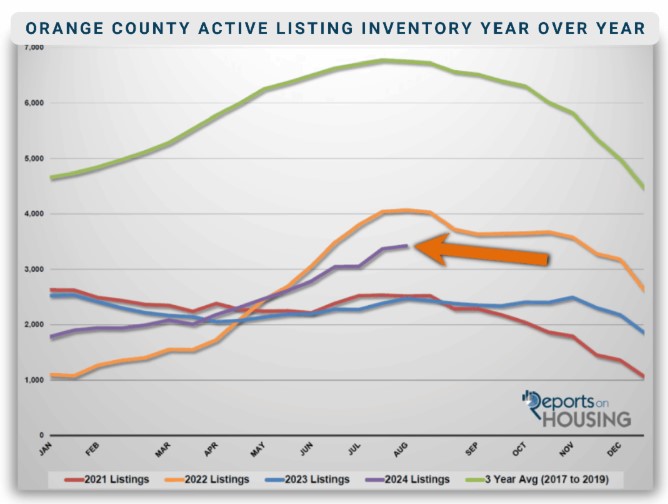

This is where buyers sitting on the sidelines are mistaken. They hear that the Fed will cut, but the headlines and news refer to the short-term Federal Funds rate, not long-term mortgage rates. When they do cut, expect credit card, automobile, and equity lines of credit rates to all drop, which are all tied to the Federal Funds rate, but NOT long-term rates utilized in purchasing homes. Can long-term rates go lower? Yes, they can. But today’s mortgage rates are already factoring in future cuts totaling 1.25%. If the economy cools even more, which the trends in the data currently support, expect rates to fall further next year. Yet, with the recent plunge, affordability has improved dramatically. More potential buyers qualify. Buyers already in the marketplace have witnessed their purchasing power increase; they can now afford a much higher-priced home. With improving affordability, demand will rise just as the inventory is about to reach its summer peak and begin to fall. As demand increases and supply falls, market times will drop. There will be more buyer competition, and values will rise again from here.

Excerpt taken from Stephen Thomas