Buyers Against the Ropes

The insane housing market has been frustrating buyers for more than a year now with unbelievable, relentless competition, making it exceedingly difficult to secure a home.

Buyers Should Not Give Up. The housing market will remain a Hot Seller’s Market for some time and home values will continue to rise.

“When it rains it pours.” There are times in life when it seems impossible to catch a break. All the cards feel as if they are stacked against you. That is how so many buyers have felt for over a year now. The housing market has been extremely hot since June of last year and has not let up ever since. Buyers are faced with crowds of interest on just about every home that is placed on the market. Multiple offers are the norm. Homes selling for above their list prices is the norm. Homes instantly selling is the norm. It is tough to be a buyer looking to purchase in today’s housing market. It feels as if they are constantly against the ropes in a 12-round heavyweight bout.

For buyers, securing a home is exceptionally frustrating. Many are kicking themselves and wish that they could have purchased a year ago, knowing that homes have appreciated at record levels ever since. Yet, that kind of thinking is futile. Home values have gone up for decades. Rather than dwelling on the past, it is best to look at where housing is at today and where it is headed in the future.

To gauge where housing is today, it is crucial to look at supply, the number of homes available to purchase, demand, the number of pending sales in the prior month, and the speed of the market, market time. The active inventory is at 2,289, the lowest level since tracking for this time of the year. The 3-year average from 2017 to 2019 (intentionally leaving out last year due to the skew from COVID) is 6,520 homes, 185% more than today’s level, an extra 4,231 FOR-SALE signs. It has not helped that there have been 1,720 fewer homes placed on the market compared to the 3-year average, 6% less.

Even with fewer available homes, demand (the last 30-days of pending sales) has been running persistently hot. The 3-year average from 2017 to 2019 is 2,363 pending sales, 10% less, or 260 fewer than today’s 2,682 level. Hot demand combined with a supply crisis has resulted in an Expected Market Time (number of days between coming on the market and opening escrow) at ultra-low, unprecedented levels. It is at 26 days today and has been stuck below the 40-day threshold since January, indicative of an insane market with tons of showings, multiple offers, selling prices above their list prices, and swift appreciation.

The current market dynamics point to a continued supply crisis with fewer homes entering the fray, elevated demand due to unrelenting historically low mortgage rates, and an insane Expected Market Time remaining steadfastly below 40-days. This is a recipe for continued multiple offers, continued throngs of buyers jumping at everything placed on the market, and continued appreciation.

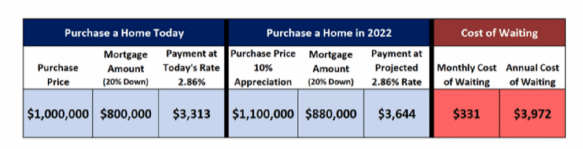

Knowing where the market is today and where it is headed from here is very important. When buyers qualify to purchase and are comfortable with the monthly payment, they can take heart that they are taking advantage of today’s remarkable, historically low mortgage rate environment, and that home appreciation will endure for the foreseeable future. In comparing a home purchased today for $1 million with a 20% down payment, the monthly payment is $3,313 at 2.86%. Home appreciation will slow a bit over the next year, from 20% today to about 10%. If rates stayed the same, the $1 million home would appreciate to $1.1 million in a year, and the payment would be $3,644 per month. That is $331 extra every month, or an annual increase of nearly $4,000, by holding off a home purchase for a year.

Excerpt taken from an article by Steven Thomas.