Housing demand has skyrocketed due to historically low rates that are not going anywhere anytime soon.

The Impact of Low Rates: A buyer’s purchasing power has dramatically improved thanks to ultra-low mortgage rates.

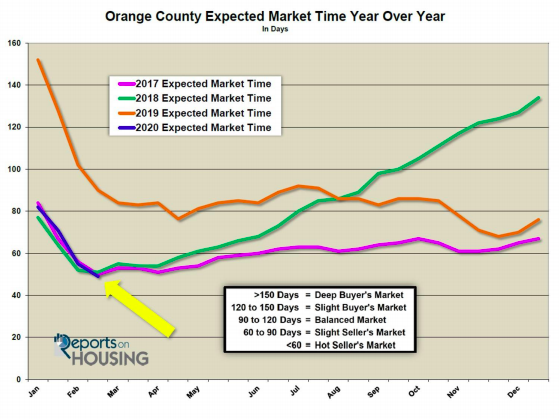

Attending an air show for the first time is quite an experience, especially when fighter jets take off and rocket across the sky. The blast from the engines is deafening, the orange glow from the afterburners is visible from the ground, and the powerful vibrations can be felt coursing through a spectator’s body. It is the specially designed jet fuel that allows these aircrafts to soar through the air. Housing has “specially designed jet fuel,” also known as ultra-low mortgage rates, that is allowing the market to soar in 2020. These historically low rates are not going to budge much from the mid-3’s. And, the recent news of the coronavirus has driven mortgage rates lower over the past month. The Orange County housing market is extremely hot, and as the year unfolds the heat continues to crank higher and higher. The slower markets of 2018 and the first half of 2019 now seem like a distant mirage to most buyers. For a minute, buyers looked as if they were finally going to get a turn, but that all disappeared. In 2020 housing is sizzling hot again. To understand where this heightened demand and buyer’s exuberance is coming from it is necessary to consider where interest rates have historically been and their impact on affordability. The chart below highlights how higher interest rates limit the price of a home that a buyer can afford. In 1980, the average mortgage rate was 13.75%. For a desired monthly payment of $3,000 per month with 20% down, a buyer back then was looking at a $338,750 home. Rates continued to drop decade after decade. In 2000, the 8% mortgage allowed a buyer to look at purchasing a $511,250 home. It increased to a $602,500 home just prior to the Great Recession. Flash forward to today’s 3.5% mortgage rate and that buyer desiring a $3,000 per month payment is now looking at an $835,000 home.