There has been a “supply problem” for quite a while, and now there is a “demand problem” at the same time.

Supply and Demand: A low supply is confronted with low demand.

There are a lot of people that assume the worst. Because of COVID-19 and the “stay at home” order across the United States, the economy has come to a complete halt and it has been thrown into an instant recession (better described as a “pandession”). As a result, the minds of so many immediately gravitate to the last recession, the Great Recession. That is when housing took a giant hit, and in Orange County values dropped 30%. Everyone was either impacted by the freefall of values or knew someone that was hurt by the unprecedented real estate slump. Since this is another recession, values will certainly drop, correct? Not so fast, it all boils down to supply and demand.

Here’s a quick history lesson as to what happened leading up to the Great Recession. In March of 2007, the subprime lending industry collapsed. Demand instantly dropped to levels that were much like today. Yet, there were over four times the number of homes on the market compared to today, reaching nearly 18,000 homes. With very low demand and a huge supply of homes, the housing market ground to a halt and home values plunged. The presence of so many risky subprime loans, pick-a-payment loans, and zero down payment loans in the system, the collapse in the credit and housing market was followed by a tsunami of distressed properties. The overly abundant supply and unstable credit foundation of the housing stock led to the tumble in values.

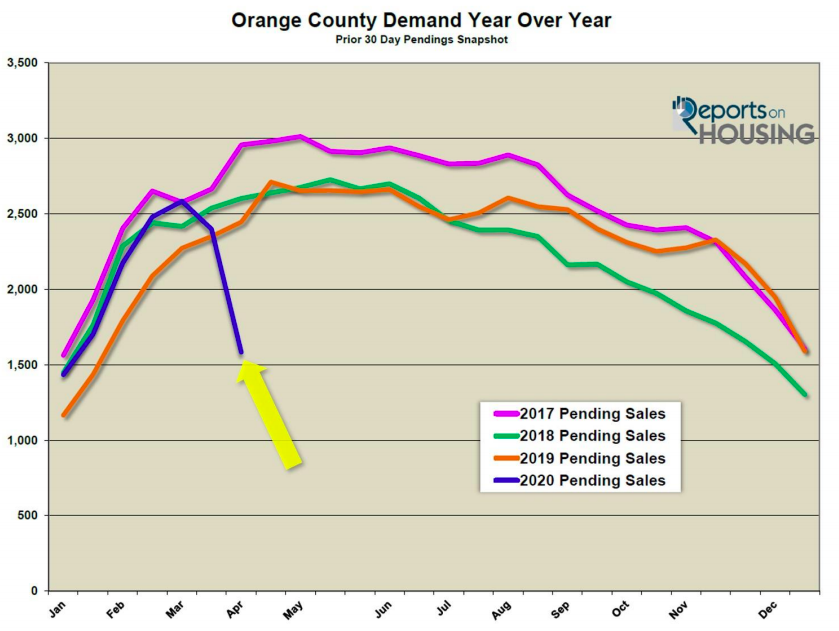

That’s just not where housing is today. Yes, there is now a “demand problem,” where buyers’ activity has substantially slowed to Great Recession levels. It’s unbelievable how demand shifted so quickly from humming on all cylinders one month ago to a snail’s pace today. Yet, the “demand problem” is starkly contrasted with the “supply problem,” there simply are not enough homes listed for sale. The showdown between both supply and demand are two countering forces that are moving housing to a Balanced Market, a market that does not favor buyers or sellers and values do not change much at all. Low demand pushes the market in the buyer’s favor; however, the low supply pushes it in the seller’s favor. As a result, a balance occurs.